Tax rates are configured separately in Retail POS and eCom. If your item uses a different tax rate than the default, assign it to a tax class with an alternative rate in both Retail and eCom. This is useful, especially in the United States, where some types of items are taxed at different rates according to local laws.

Automatic tax creation in Retail

The rules governing tax rates are more complicated when selling online than in-store because the shipping destination must be considered. For this reason, it isn't possible to use Retail's tax system for selling online.

Retail is not set up ahead of time with all the possible tax rates that could be used in eCom. Instead, when new tax rates are required to process a sale, the system creates them.

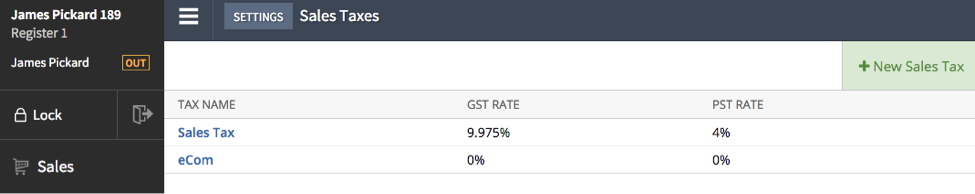

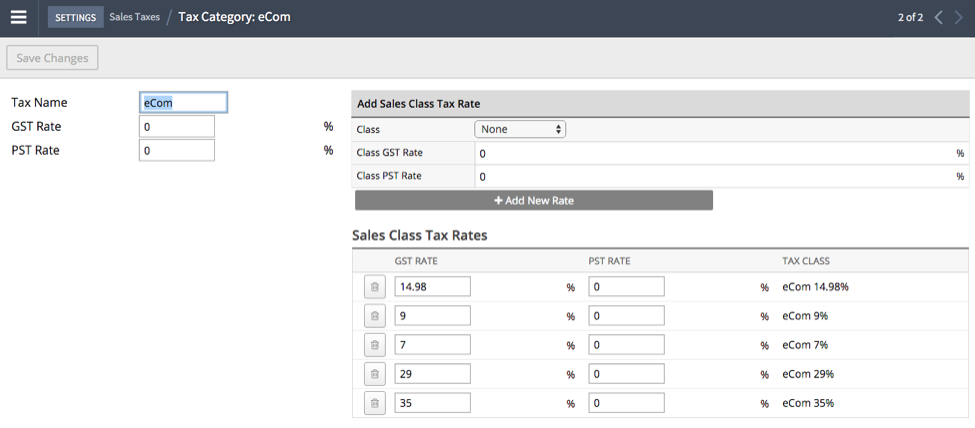

Every time a sale is made in eCom, the system checks each sale line and determines whether a new tax rate is needed in Retail. Tax rates created by the system are grouped under an eCom Sales Tax.

Grouped under the eCom Sales Tax is a Tax Class for each rate that has been used in eCom.

Updating solar panel taxes (NL)

Netherland-based businesses selling solar panels require different taxes for private individual customers (0% tax) and business customers (21% tax). These taxes can't be set up through product import.

For larger businesses, set the taxes up through an API. Contact your Customization Partner for more information.

To manage the different solar panel taxes for private and business customers:

- Navigate to Products.

- Use the filters to find and select the solar panel product variant.

- In the Inventory & Variants section, click the title to display the Edit variant window.

- In the Prices section, click the Tax rate dropdown, and select the 21% Solar panel tax rate.

- Click the Tax Type dropdown, and select Solar Panels (NL).

- Click Save.

With this configuration, private individual customers in the Netherlands will automatically be charged 0% tax on solar panel purchases. Other customers, including businesses in the Netherlands and customers in the EU, will still have a 21% tax applied to their solar panel purchases.

If you need to apply solar panel taxes in bulk:

- Navigate to Products

- Use the filters to find and select the solar panel product variants.

- Select Edit from the Items selected dropdown.

- In the Inventory & Variants section, select the Tax checkbox.

- For the Are all the values the same? dropdown, select Yes.

- Click Save.

What's next?

Managing shipping, store pickup, and pay at pickup in eCom (C-Series)

Manage delivery, in-store pickup, and payment at pickup options.

Learn moreViewing eCom (C-Series) sales reports in Retail POS (R-Series)

View and understand sales reports.

Learn more