Making Tax Digital is a key part of the United Kingdom government’s plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs. This is one of two reports we've added to Lightspeed Retail POS for users in the UK to facilitate the transition.

The UK Digital Normal VAT report will include the line items sold within a specified date range at a transactional level that includes all of the relevant information needed to submit your VAT return.

Exporting the UK Digital Normal VAT report

To export the csv file:

- Navigate to Reports.

- Under Making Tax Digital UK, click UK Digital Normal VAT Report.

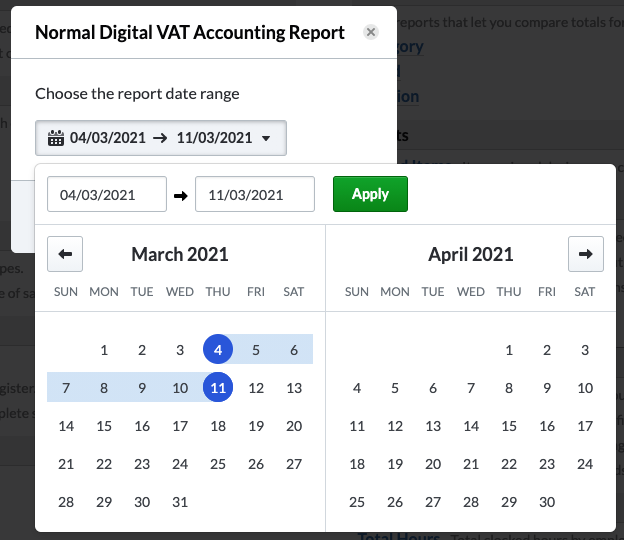

- Select the date range you'd like the report to include.

Note: the date range selected here is exclusive, so in the above example, sales from March 4th and March 11th will be excluded from the report. - Click Apply.

- Click Get Report.

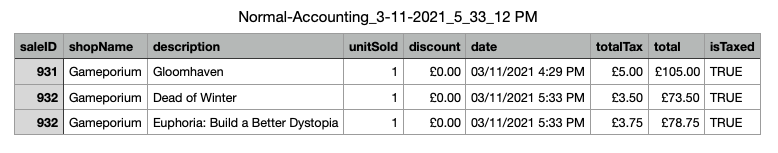

The report will immediately be generated and downloaded in .csv format. You can then open the report with your preferred spreadsheet application.

The report will include all line items sold during the specified date range with the following information:

- the Retail POS sale ID for the sale the item was sold in

- the shop name where the item was sold

- the description or name of the item that was sold

- the quantity of units sold

- the total value of any discounts applied to the item

- the date the item was sold

- the total tax value generated by the sale of the item

- the total sale price of the item after taxes and discounts have been applied

- whether or not the item was taxed, expressed as a TRUE (taxed) or FALSE (tax exempt) value

In addition to this report, you'll also need the UK Digital Retail VAT Report when submitting your VAT return.